The surge in Adani Group shares can be attributed to a recent development reported by Bloomberg. According to the Bloomberg report, an investigation conducted by a US agency into the allegations raised by Hindenburg against the Adani Group has concluded, clearing the group of any wrongdoing. The US agency in question, the International Development Finance Corp (DFC), deemed all the accusations made by Hindenburg against the Gautam Adani-led group as unfounded.

This positive outcome from the investigation has had a notable impact on the sentiment surrounding Adani Group shares, leading to an intraday rally. A senior US official has also affirmed that the US government views Hindenburg Research’s claims of corporate fraud against Adani as baseless. The surge in shares on Monday is further linked to the completion of a Supreme Court case hearing, adding to the positive developments surrounding the Adani Group.

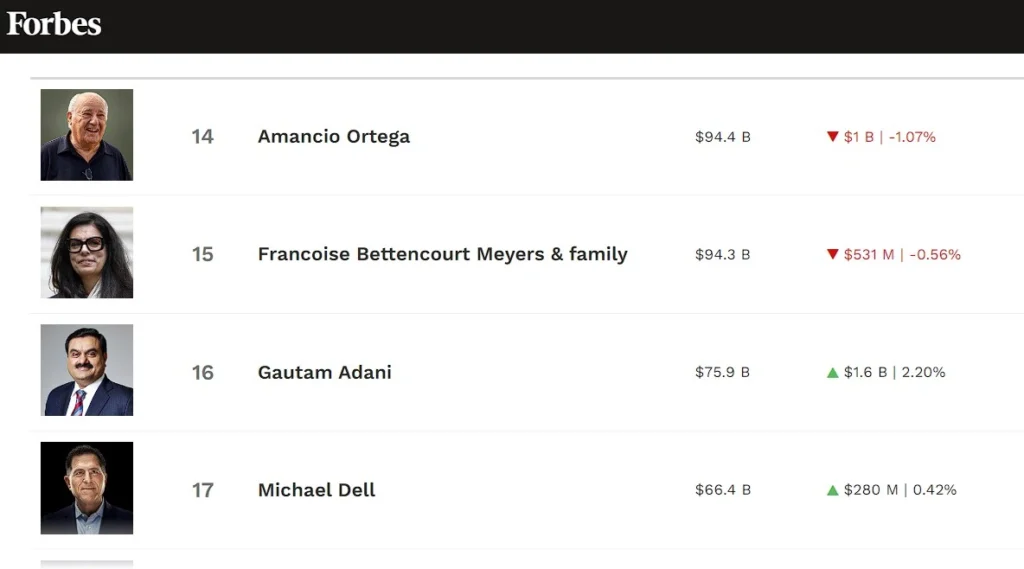

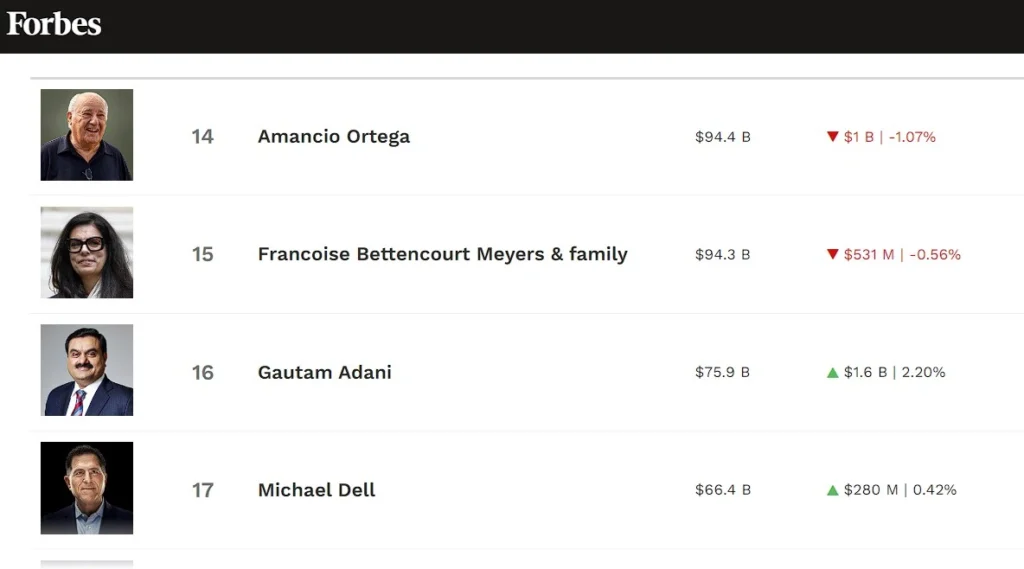

Gautam Adani at 16th on the list of rich

Gautam Adani has now secured the 16th position on the list of the wealthiest individuals, propelled by the substantial surge in Adani Group shares. The surge in shares has translated into a remarkable increase of Rs 1 lakh crore in Gautam Adani’s wealth within a single day. As a result, his overall wealth has reached a staggering Rs 6.3 lakh crores or $75.9 billion.

It is noteworthy that despite this impressive increase, there remains a deficit of 38 billion dollars in Adani’s wealth for the current year. This deficit emerged after Adani, following the release of the Hindenburg report, initially slipped to the 24th position on the list of the richest individuals. The recent surge in Adani Group shares has not only restored his standing on the list but has significantly elevated his position to the 15th spot.

Some Facts About Gautam Adani Net Worth

Gautam Adani’s Leadership: Gautam Adani serves as the chairman of the Adani Group, a conglomerate with a revenue of $32 billion. The group has diverse interests including ports, airports, power generation and transmission, and green energy.

Adani Group’s Origin and Expansion: Originating as a commodities trading firm in 1988, the Adani Group expanded its portfolio over the years through strategic acquisitions. This growth was facilitated with the support of Indian Prime Minister Narendra Modi.

Gautam Adani Accusations by Hindenburg Research: In January 2023, Hindenburg Research, a U.S. firm, accused Gautam Adani and his companies of engaging in financial fraud and stock market manipulation. The Adani Group, however, has vehemently denied any wrongdoing in response to these allegations.

Gautam Adani Prominent Positions in Infrastructure: Gautam Adani holds significant positions in the infrastructure sector. He is India’s largest airport operator and controls Mundra Port, which is the largest port in India, situated in his home state of Gujarat.

Gautam Adani Expansion into Cement Production: In 2022, Adani became India’s second-largest cement producer following the acquisition of Swiss firm Holcim’s Indian assets. This substantial acquisition amounted to $10.5 billion.

Conclusion

Gautam Adani’s net worth has surged by $10 billion in a week, reaching $70.3 billion and making him the 16th richest on the Bloomberg Billionaires Index. A recent rally in Adani Group shares, fueled by positive outcomes from a US agency’s investigation into allegations of financial wrongdoing, played a key role. Adani’s wealth saw a remarkable increase of Rs 1 lakh crore in a day, reaching Rs 6.3 lakh crores or $75.09 billion. Despite earlier challenges, the surge has not only restored but significantly elevated Gautam Adani’s position among the world’s wealthiest individuals.

FAQ: