Tata Motors Q3 result 2024 highlights a remarkable performance, with soaring profits and increased sales. The positive trend is set to continue, influencing bullish share price targets for 2024 and 2025.

Tata Motars Q3 Result 2024

Tata Motors showcased an impressive performance in the October-December quarter of 2023, with its consolidated net profit soaring to Rs 7,025 crore, marking a twofold increase from Rs 2,957.71 crore in the same period the previous year.

The stellar results were fueled by a combination of factors, including strong demand for both passenger and commercial vehicles in India, sustained growth in Jaguar Land Rover models, reduced raw material costs, strategic price hikes, and an enhanced product mix.

Tata Motors Q3 Result 2024 Analyst Expectation

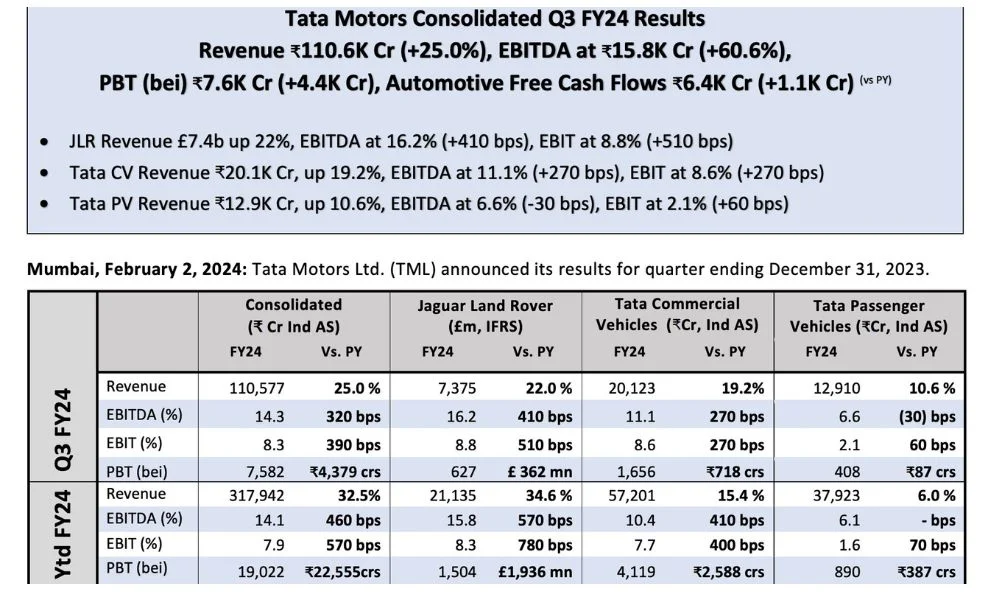

The company’s revenue also experienced a robust uptick, surging by 24.9 percent year-on-year to reach Rs 110,577 crore, compared to Rs 88,489 crore in the corresponding quarter of the previous year.

These impressive figures surpassed the expectations of analysts, who had anticipated a 54 percent YoY growth in net profit to Rs 4,547 crore and a 22 percent YoY increase in revenue to Rs 1,08,169 crore, according to estimates from seven brokerage houses.

Tata Motors Q3 Result 2024: EBITDA

Tata Motors revved up its performance in the third quarter of the fiscal year 2023-24, witnessing a noteworthy increase in total vehicle sales. The company reported a total of 234,981 vehicles sold across domestic and international markets, surpassing the previous year’s Q3 figure of 228,169 units.

Tata Motors reported a significant jump in its earnings before interest, taxes, depreciation, and amortization (EBITDA), recording a sharp 42.5 percent YoY increase to Rs 15,333 crore. Furthermore, the operating margin witnessed a noteworthy expansion, growing by 171 basis points to 13.94 percent.

These financial indicators underscore the company’s commitment to operational excellence and strategic decision-making.

Tata Motors Share Price Today

Tata Motors Share Price Is at 882.80 INR, reflecting a modest increase of 4.30 INR or 0.49%. The day commenced with an opening value of 886.00 INR.

The stock reached its highest point during the session at 895.75 INR, while the lowest point touched was 876.85 INR.

Tata Motors Share Price Revenue and Operating Performance:

- Total Revenue: Tata Motors’ revenue for Q3 of the current fiscal increased by 25% to ₹110,577 crore, compared to ₹88,488.59 crore.

- EBITDA Growth: The earnings before interest, taxes, depreciation, and amortization (EBITDA) surged by 59% to ₹15,333 crore, up from ₹9,644 crore in the same period last year.

- EBITDA Margin: The operating margin (EBITDA margin) stood at 13.9%, up by 300 basis points from 10.9% in the previous year, indicating a profitable growth trend across all automotive verticals.

- Profit Before Tax: Profit before tax climbed to ₹7,493 crore in Q3 of the current fiscal compared to ₹3,202 crore in the same period the previous year.

Tata Motors Q3 Result 2024 Scorecards

JLR Q3 Performance

- Revenue Growth: Jaguar Land Rover’s (JLR) revenue for the December quarter increased by 22% to £7.4 billion, reaching a year-to-date revenue of £21.1 billion, marking the highest ever in the first nine months of a financial year.

- EBIT Margin: JLR achieved a positive EBIT margin of 8.8% in the December quarter, more than double from the year-ago period.

- Profit Before Tax: The profit before tax for JLR was £627 million in the quarter, the highest quarterly profit since Q4 FY17.

- Guidance Update: JLR increased its EBIT margin guidance for FY24 to over eight percent, compared to the previous guidance of around eight percent.

Tata Commercial Vehicles (CV):

- Revenue Increase: Tata Motors’ Commercial Vehicles (CV) segment witnessed a 19.2% revenue increase to ₹20,123 crore, driven by a focus on medium and heavy commercial vehicles and improved market operating prices.

- Margin Improvement: Strong EBITDA and EBIT margins of 11.1% and 8.6%, respectively, in the December quarter, attributed to better pricing, a superior product mix, and strong realizations.

- Volume Overview: Domestic wholesale CV volumes were marginally higher at 91.9K units YoY, with exports increasing by 14% YoY to 4.8K units.

- Outlook: Tata Motors anticipates improved demand in Q4 FY24 across most segments due to demand-pull initiatives.

Tata Passenger Vehicles (PV):

- Revenue Growth: Tata Motors’ Passenger Vehicles (PV) segment reported a 10.6% YoY revenue increase to ₹12,910 crore.

- EBIT Margin Improvement: EBIT margins improved by 60 bps YoY to 2.1%, attributed to cost savings in commodities offsetting higher fixed expenses.

- Electric Vehicle (EV) Business: The EV business EBITDA margins, pre pre-R&D spending, were near breakeven.

- Volume Overview: PV volumes reached 138.6K units, a 5% YoY increase, supported by a strong supply situation, new SUV facelifts, and robust demand during the festive period.

READ ALSO: Tata Steel Posts Q3 Profit Lower costs offset weak revenue

Market Response: Tata Motors Shares

On February 2, Tata Motors’ shares on the BSE witnessed a modest increase of 0.05 percent, closing at Rs 878.80 apiece.

This positive market response reflects the confidence and momentum generated by the company’s robust performance in Q3.

Tata Motors maintains a positive outlook for all three auto businesses in the near term. The company anticipates further performance improvement in Q4, attributing it to seasonality, new launches, and enhanced supplies at Jaguar Land Rover.

The regulatory filing to stock exchanges highlighted a net debt reduction of Rs 9.5K crore in Q3, reinforcing the company’s confidence in achieving its deleveraging plans.

Tata Motors Share Price Target 2024

Many Indian stocks, including TATA MOTORS, have enjoyed a strong bullish trend throughout 2023. Looking ahead to the first quarter of 2024, it seems the positive market sentiment will persist, although some initial consolidation is anticipated in the early months.

According to technical data, the projected share price for TATAMOTORS in 2024 indicates a potential low target of ₹822.03 and a high target of ₹882.54.

Tata Motors Share Price Target 2025

The outlook for TATAMOTORS appears promising, with a projected share price of Rs. 936.71 by January 2025. The forecast extends through the year, suggesting a potential upward trend. February kicks off with a target of ₹946.84, followed by a range of values that hover around the ₹931 mark from March to December 2025.

These predictions are contingent on favorable Macro and Micro economic factors, coupled with industry trends aligning in support.

Investors will be keenly observing how these variables unfold, achieving the December 2025 target of ₹931.48 on the continued positive trajectory witnessed in the earlier months.